So if your company has only a few clients this may not be one of the best financing solutions. Requires a large amount of clients – In order to be profitable and minimize risk, factoring companies generally look for companies that have a relatively large amount of outstanding invoices.Receivable factoring relies mainly on the validity and value of the invoices. In addition, invoice factoring companies rarely require a credit check, minimum credit score or a report on credit worthiness or personal credit. High Approval Rates – Compared to other types of financing such as: business loans, traditional bank loans, term loans, lines of credit or other financing options, invoice factoring has very high rates of approval.In many cases, the additional fees charged by factoring services is less than maintaining accounting staffing. This eliminates accounting overhead by assigning the job of collections to a third party. Outsourcing overhead for accounting – It also may relieve the business owner from the responsibility of chasing payments and accounts receivable.For companies with many clients, this could add-up to a lot of money. If your small business offers payment terms to clients, you will typically have to wait 30 days to get paid.

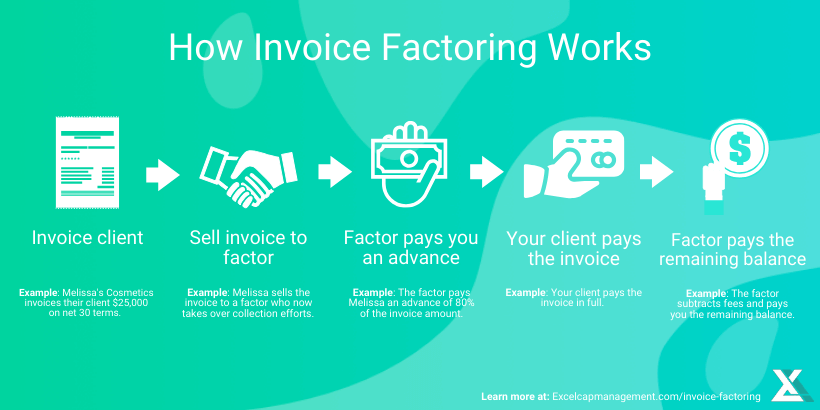

The invoice financing company will remit any portion of funds from paid invoices (minus any additional fees, if applicable).They will also pursue late payments from customers. The customers will then pay the invoice financing company directly (they are essentially an accounts receivable facility).The amount of invoice discount and upfront payment can vary on a number of factors including the types of business, age of the outstanding invoices, and other factors. The invoice financing company then pays a percentage of the invoice value to the business owner immediately after doing the due diligence that the invoices are valid.

#Invoice factoring vs invoice financing full

The small business owner then sells or assigns the right to collect the full value of outstanding invoices to an invoice factoring company through an invoice factoring agreement.Small business owner sells products or services to their customers as they normally do.The invoice factoring services make their money on the spread between the total invoice amount and the discount rate they pay the small business owner. That invoice factoring company pays small business owners a discount rate or an advance rate on the face value of the invoices, then collects the full value of the invoices. As mentioned above invoice factoring is a type of financing where a small business owner agrees to “sell” or assign unpaid invoices or outstanding invoices to a third-party such as a lender who provides factoring services.

0 kommentar(er)

0 kommentar(er)